In the high-stakes realm of revenue generation, chief revenue officers must blend strategic acumen with flawless execution. This article spotlights best practices that distinguish chief revenue officers whose leadership and competencies ensure their company capitalizes on growth opportunities.

What Is a Chief Revenue Officer?

A chief revenue officer, or CRO, is pivotal in the C-suite. The CRO oversees all revenue activities and ensures sales, marketing, customer success, and other teams work together to drive profits.

Unlike other executive job titles focused on singular functions, the CRO conducts the orchestra of revenue. They provide strategic guidance from 30,000 feet while understanding the tactics needed for execution. The CRO transforms high-level goals into operational realities by bridging the gap between the boardroom and the sales floor.

Whether spearheading a startup’s path to scalability or optimizing an established company’s growth, the CRO uses its cross-functional perspective to accelerate revenue. Their expertise spans pricing strategies, revenue processes, customer journey mapping, and data analysis. An effective CRO diagnoses underperformance and uncovers untapped opportunities and refines the revenue engine. Rather than just bolting on solutions, they take a systemic approach to sustainable growth.

The chief revenue officer role has never been more critical as businesses seek new revenue streams and customer-centric strategies to thrive in an uncertain world. Companies that invest in this multi-faceted leadership position will reap the rewards.

Best Practices of a Chief Revenue Officer: 8 Qualities to Strive For

In the high-stakes arena of corporate revenue generation, a chief revenue officer stands at the helm and navigates through competitive tides and ever-shifting market currents. The chief revenue officer role demands a fusion of visionary leadership and execution, where success is measured in financial terms and the ability to foresee and adapt to the evolving business landscape.

To excel as a CRO, one must embody indispensable qualities and actionable sales tips. From a deep-rooted affinity for data to a commitment to innovation and team synergy, these attributes are the cornerstones of effective revenue leadership.

1. Focused on Numbers

A chief revenue officer must have a laser focus on numbers, which includes a precise approach to tracking revenue targets, sales performance, and customer engagement metrics. Your success hinges on your ability to dive into the data that spells out your company’s financial health. It’s all about understanding the “what” and the “why” behind the numbers. Data equips you to steer your sales team toward efficient sales processes that enhance your company’s revenue.

For example, by examining sales analysts’ and sales teams’ performance data, you can pinpoint what drives revenue growth and decide where to focus your energy. Knowing your existing customers’ behavior helps you meet and exceed revenue goals through strategic up-sales and customer success initiatives.

Beyond revenue numbers, successful CROs have a keen sense of their industry. A significant 72% of CROs recruited from outside the company have over 15 years of professional experience. Additionally, a notable 76% have been employed at startup companies, while 96% have gained experience at established corporate entities.

2. Collaboration Driven

In the dynamic landscape of modern business, the chief revenue officer role is pivotal. The CRO unifies diverse departments toward a single goal and must be a master of integration and influence. As matrixed organizations lack a singular custodian of customer relationships, the onus falls on chief revenue officers to weave a tapestry of collaboration and ensure that each department contributes to revenue growth. This collaboration requires an understanding of the unique strengths of each team and the ability to harness these differences to create a cohesive, customer-centric strategy.

Crucial to this effort is the establishment of shared customer success metrics. These act as a north star and guide the collective efforts of sales, marketing, product, and service teams. Astute CROs go further and establish cross-functional committees to dissect and address the systemic barriers that impede the customer journey. Such committees are not just problem-solving entities but incubators for innovation and bring to light insights that can transform the customer experience.

Communication is the lifeblood of collaboration, especially for sales leaders. By fostering open, transparent dialogue across revenue teams, CROs can ensure that insights gleaned at one point of the entire customer journey are not lost and instead channeled into strategies. When a service agent uncovers a critical piece of customer feedback, it should not remain in a silo but should instead be used to refine marketing approaches and enrich sales training programs. Through this strategic linkage of insights and actions, CROs can create a harmonious and consistent experience across every customer touchpoint and drive sustainable revenue growth and build a resilient organizational structure.

3. Passionate About Process Improvement

In dynamic markets, even profitable models grow stale. CROs must challenge the status quo to keep revenue generation competitive. They spearhead enhancements to stay ahead of shifting customer expectations.

Forward-looking CROs pilot new technologies and processes to remove friction in the customer journey. Rather than making isolated tweaks, they take a holistic approach to transforming end-to-end systems. Effective CROs also foster a culture of experimentation and encourage teams to test new ideas in the market.

By melding revenue strategy with hands-on execution, passionate CROs drive change. Their impatience with the mediocre status quo becomes a rising tide that lifts an organization’s results. Process improvements keep the wheels of commerce turning.

4. Using the Right Tools

In an age of exponential technological change, CROs must evaluate new solutions to avoid falling behind. They arm their teams with tools that streamline processes and unlock insights. Yet simply adopting the latest bells and whistles fails to guarantee impact. Discerning CROs focus on integrating platforms that address core pain points that inhibit growth.

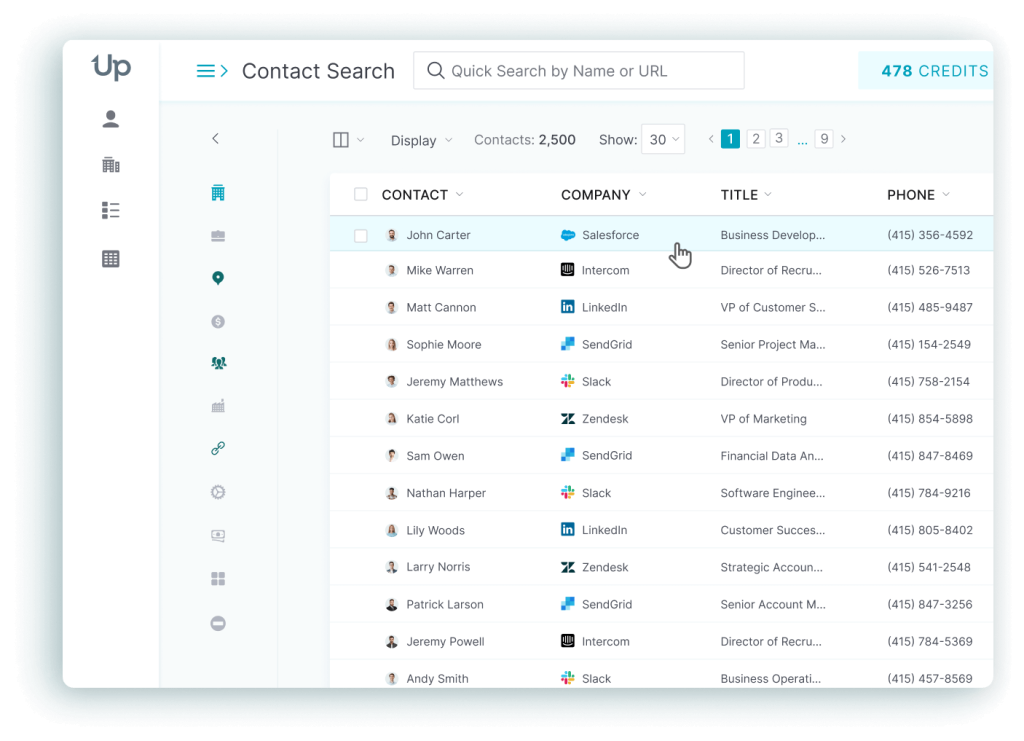

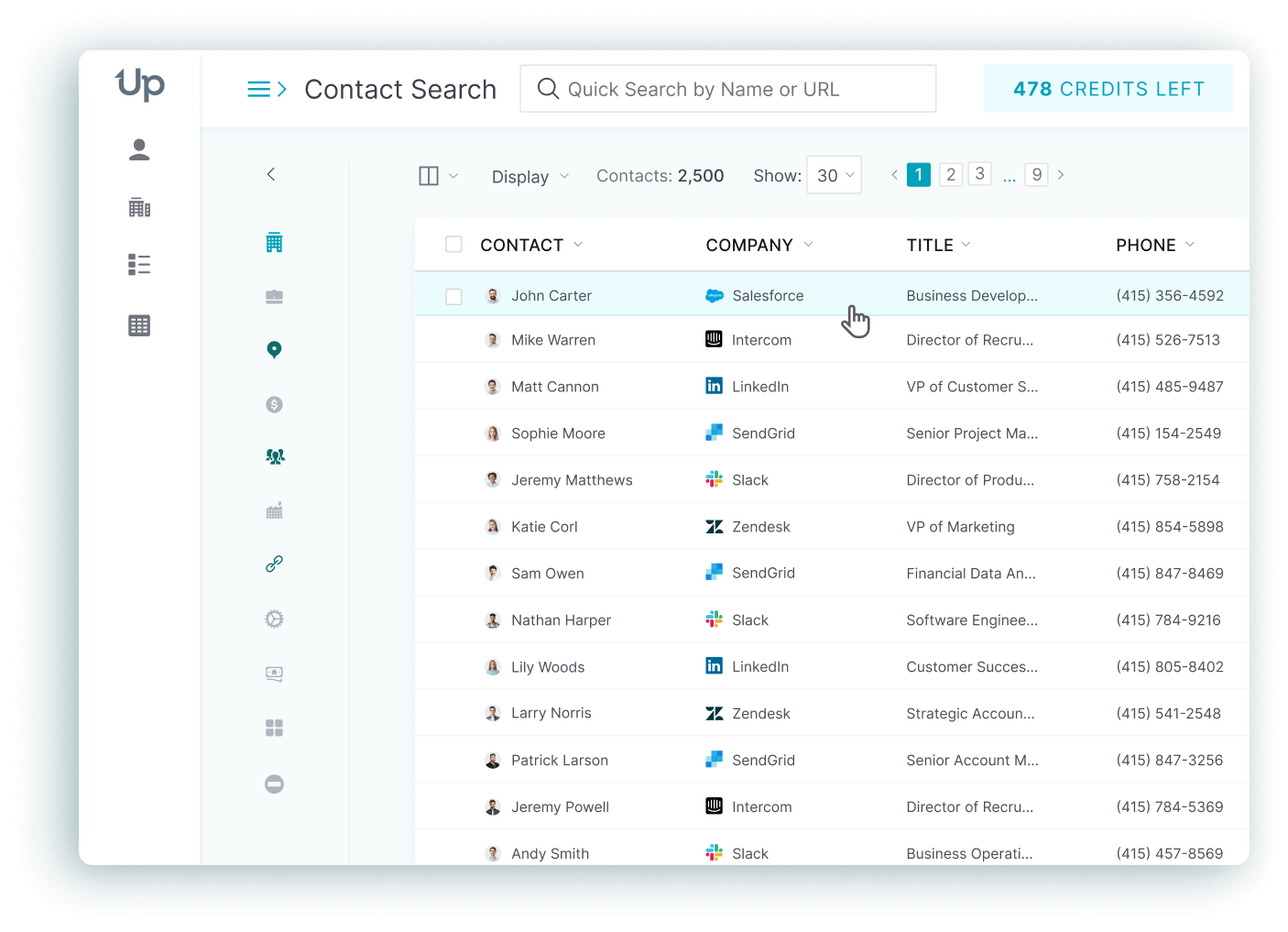

For instance, many sales teams struggle to identify qualified prospects amidst oceans of data. Powerful sales engagement platforms like UpLead can help overcome this challenge. By surfacing ideal customer profiles using advanced analytics, UpLead enables teams to focus their energy where it matters most. We also have Chief Revenue Officer Email Lists. The right technology serves as a tailwind, not just a tool. Try UpLead for free today and see the difference in your outbound prospecting.

Savvy CROs also understand that adoption hinges on user experience. They ensure salespeople feel empowered by new systems, not burdened. Training and post-implementation support are crucial to drive utilization. With the proper foundation, technologies become invaluable allies.

5. Highly Flexible

A crisis can turn into chaos, but it can also present market opportunities. Amidst uncertainty and change, CROs must remain flexible and adapt strategies without losing momentum.

Nimble CROs stay attuned to leading indicators that demand a change of course, whether emerging competitor activity, new market entrants, or market shifts in customer preferences. In response, they realign pricing, product, and promotion initiatives to capitalize on the evolving landscape.

Rather than clinging to the status quo, adaptable CROs embrace experimentation. They pilot new sales models and revenue streams and double down on what gains traction. This fluidity enables their organization to outmaneuver rivals who react too slowly to new realities.

Flexibility allows CROs to reframe challenges as opportunities to strengthen competitive positioning. Their ability to pivot keeps business growth on track through turbulent times.

6. Strong Leadership & Communication Skills

Unlike tactical roles immersed in day-to-day execution, CROs must provide strategic leadership across multiple stakeholders, from the C-suite to frontline teams. This leadership requires excellent communication skills to share strategic vision clearly and persuasively.

Effective CROs distill complex ideas into simple, compelling narratives that resonate across audiences. They paint a vivid picture of future success that rallies their teams around shared goals. Especially during times of transformation, their ability to connect strategy with specific actions is vital for alignment.

Strong leaders also listen to identify the root causes of organizational disconnects. They grasp that coordination issues often reflect communication breakdowns rather than malicious intent. With compassion and emotional intelligence, CROs build bridges across team divisions.

By blending strategy with impactful communication, CROs catalyze teams to achieve more together than alone. Their ability to inform, inspire, and connect propels an organization forward.

7. Doesn’t Mind Pressure

The chief revenue officer role puts intense pressure on delivering sales results. With revenue generation the lifeblood of any organization, all eyes focus on the CRO. Some may find the weight of expectations overwhelming. However, thriving CROs possess the resilience to withstand short-term scrutiny and drive long-term success.

By its very nature, the chief revenue officer position requires making difficult decisions with imperfect information. When strategic initiatives miss the mark, successful CROs remain composed. They diagnose setbacks as opportunities for improvement. With a steady hand, CROs apply lessons learned to refine strategies and reallocate resources. They understand that missteps are inevitable and growth depends on how you bounce back.

Effective CROs also exude calm confidence and remain accountable even in the worst of times. They communicate challenges without sugarcoating realities. This communication breeds trust and credibility across the C-suite. High-pressure climates demand levelheaded revenue leadership.

Chief Revenue Officer Responsibilities

As masters of the company’s financial destiny and similar to Chief Financial Officers, chief revenue officers wear many hats while juggling myriad responsibilities:

- Architecting Revenue Strategy – CROs design blueprints that cover markets, channels, resources, and sales forecasts. This big-picture thinking is their springboard for action.

- Leading Cross-Functional Teams – By overseeing sales, marketing, customer success, and revenue operations, CROs ensure interconnectedness between siloed departments. They break down barriers that inhibit the revenue cycle.

- Managing Performance – With an eye on the pipeline’s health, CROs monitor and address issues that impede sales. A combination of technology implementation, process refinement, and motivation helps optimize productivity.

- Enhancing Customer Relationships – CROs analyze buyer journeys and touchpoints to strengthen retention and loyalty. A spirit of customer-centricity permeates all they do.

- Identifying Revenue Opportunities – Whether launching new products or exploring untapped segments, the CRO helps determine avenues for top-line growth.

- Providing Strategic Counsel – With complete visibility into the revenue engine, CROs offer vital perspectives on how to fuel growth and align sales operations with corporate strategy.

- Overseeing Data Analysis – CROs evaluate performance metrics on lead costs, sales, and customer behavior to pinpoint areas for improvement.

Which KPIs Should a CRO Own?

The KPIs a CRO should own are NRR, GRR, CAC payback, win rate, sales cycle, and forecast accuracy, because these metrics capture growth, durability, and predictability of the revenue engine. Research highlights retention as the strongest growth lever for B2B SaaS, with higher NRR correlated to higher growth.

NRR (Net Revenue Retention) = (Starting MRR + Expansion − Contraction − Churn) ÷ Starting MRR.

Target: ≥110% for strong performance; top performers exceed 120%. Recent benchmarks show median NRR around 102–106% depending on ACV and stage.

GRR (Gross Revenue Retention) = (Starting MRR − Churn) ÷ Starting MRR.

Target: ≥90–95%; median GRR often ~90–92% in private SaaS.

CAC Payback (months) = Sales & Marketing cost to acquire $1 of new ARR ÷ Gross margin per $1 of ARR.

Target: ≤12 months at growth stage; shorter is better for efficiency.

Win Rate = Closed-won ÷ Qualified opportunities.

Target: Calibrate by segment/ACV; track trend alongside stage exit criteria.

Sales Cycle = Average days from first qualified meeting to close, by ACV band.

Target: Decreasing trend at unchanged ACV signals improved pipeline quality.

Forecast Accuracy = 1 − |Forecast − Actual| ÷ Actual.

Target: 85% is strong; 90–95% is best-in-class in B2B sales organizations.

Publish these KPI definitions in your GTM handbook with owners and target ranges, then review weekly (ops sync) and monthly (forecast meeting) to steer resources toward retention and expansion drivers.

What Should a CRO Do in the First 90 Days?

A CRO’s first 90 days should establish baselines, fix the revenue system, and prove predictability, because retention and operating rhythm are the strongest predictors of durable growth and tenure.

Days 1–30 — Listen & baseline:

Audit pipeline stages and exit criteria; rebuild the forecast model and definitions; map customer health signals to identify near-term expansions; confirm ICP/segmentation and capacity model.

Days 31–60 — Align & fix:

Institute a weekly pipeline review, standardize stage hygiene, remove stalled deals, and launch two expansion plays (e.g., usage-based upsell and multi-seat packaging). Align shared OKRs across Sales, Marketing, and CS (e.g., MQL→SQL conversion, NRR contribution).

Days 61–90 — Scale & prove:

Lock quarterly GTM OKRs, run the first QBR, publish a win-loss summary, and deliver forecast accuracy ≥85% with a plan to reach 90–95%. Start monthly board-ready reporting on NRR/GRR, pipeline coverage (≥3× next-quarter quota), and capacity.

share this 30/60/90 as a one-pager with the CEO and keep a public risks/assumptions log and tie each action to a KPI from the section above.

How Should a CRO Design for Retention and Expansion?

A CRO should design for retention and expansion by owning GRR and NRR targets and operationalizing leading indicators, because revenue durability compounds growth and is scrutinized first by boards and public-market analysts.

Set targets: Median NRR 102–106% and GRR ~90–92% are common; strong performers drive NRR ≥110%, top quartile ≥118–120%. Tie quotas and CS goals to those thresholds.

Instrument leading indicators: Define a customer health score (product usage, adoption milestones, support risk, executive alignment) and trigger playbooks 90 days pre-renewal.

Design expansion plays: Price/packaging for seat growth, usage thresholds, and success milestones; create expansion pipeline with explicit stages and owners.

Publish a one-page NRR operating model that lists owners, health inputs, renewal timelines, and the two expansion motions that will contribute ≥30% of your quarterly NRR delta.

What Operating Cadence Keeps Revenue Predictable?

The operating cadence that keeps revenue predictable is a weekly pipeline review, a monthly forecast meeting, and a quarterly business review (QBR), because repeatable rituals enforce stage hygiene, improve forecast accuracy, and align cross-functional owners. Large-scale surveys of sales organizations show teams formalizing enablement and governance to drive predictability.

Weekly pipeline review: Inspect deals by stage exit criteria, remove stale opportunities, and maintain ≥3× next-quarter coverage at segment level.

Monthly forecast meeting: Publish commit/most-likely/best-case, review top-risk deals, and reconcile Marketing and CS inputs.

Quarterly business review: Report GRR/NRR, segment P&L, pricing/packaging experiments, enablement impact, and capacity plan.

Keep a single “Revenue Rhythm” calendar that lists these rituals, required inputs (dashboards), and decision outputs (owner + due date).

What Is the Average CRO Tenure?

The average CRO tenure is about 25 months, which is the shortest among many C-suite roles and underscores the need to fix systems rather than rely on heroics. Harvard Business Review’s 2024 analysis highlights the churn and its costs for organizations.

Why it matters: Short tenure compresses the window to establish an operating rhythm, rebuild forecasts, and prove NRR improvements. Tie your first-90-day plan to forecast accuracy and retention deltas to de-risk execution and set realistic expectations with the board.

Align with the CEO on three tenure-critical outcomes: ≥85% forecast accuracy in 90 days, NRR trending toward ≥110%, and shared OKRs across Sales/Marketing/CS.

8. Forward-Thinking Mindset

Fast-evolving markets demand that CROs keep their sights on the road ahead, not just what’s in the rearview mirror. While analyzing past performance provides context, CROs must look forward to stay ahead of the curve. They monitor their competitive landscape for signals that markets are poised to shift.

Leading CROs also encourage teams to envision possibilities beyond today’s reality. By exploring emergent technologies and piloting inventive sales models, they get a glimpse into the future taking shape. Equipped with foresight, CROs realign strategies and investments to capitalize on upcoming market trends before rivals.

Forward-thinking CROs also recognize that the foundations for future growth are laid today. They focus on ingraining customer-centric cultures and nurturing talent. CROs ensure they don’t stand still by anticipating the skills and mindsets their organizations need tomorrow.

CROs who can visualize the road ahead steer their company toward new sustainable growth horizons. The future belongs to the forward-thinkers.

What Makes a Successful Chief Revenue Officer?

More than just excelling at individual competencies, exceptional CROs exhibit a blend of complementary attributes that enable strategic impact. Here are a few hallmarks of standout CRO performance:

- Strategic Acumen – Top CROs maintain a big-picture view of market forces while connecting tactics to overarching goals. They align revenue teams to the company’s north star.

- Data Fluency – Using analytics to inform decisions separates leading CROs. KPI dashboards become their trusted cockpit.

- Innovative Mindset – Forward-thinkers pilot new technologies and business models to stay atop changing customer needs. They reimagine systems versus optimizing the status quo.

- Cross-Functional Leadership – Influential CROs foster seamless coordination across the revenue lifecycle by bridging organizational divides.

- Change Management – During transformation, nimble CROs communicate visions, align stakeholders, and drive the adoption of new processes.

- Resilience Under Pressure – The greatness of successful CROs emerges under scrutiny. They remain composed and accountable.

- Customer Advocacy – The admired CROs ensure revenue strategies deliver win-win value by keeping the end customer at the forefront.

The best CROs synthesize strengths across these areas into a cohesive leadership approach that elevates their entire revenue organization’s performance.

FAQs About CRO Best Practices

Below are a few of the most asked questions about best practices of chief revenue officer.

CROs focus on various performance metrics to gauge success, including revenue growth, average selling price, revenue per customer, churn rate, customer lifetime value, and sales team performance.

When seeking a CRO, look for strong leadership qualities, revenue generation experience, customer and operations expertise, and a proven track record of meeting or exceeding revenue goals.

To be a better CRO, refine your strategic thinking, stay abreast of market trends, invest in sales enablement tools, and foster a customer-centric culture.

CROs care about aligning the revenue-generating functions with the company’s strategic objectives, optimizing sales processes, and maximizing revenue opportunities.

The average tenure of a CRO is about 25 months, which is the shortest among many C-suite roles, reflecting the high demands and fast pace of the role and underscoring the need to fix systems rather than rely on heroics.

CRO compensation ranges from about $350K to $2M+ in total annual packages depending on company stage, with bases at scale (e.g., $200M+ ARR) often around $400K+ and bonus targets of 100%+, with equity varying by ownership and growth profile. Recent executive-search benchmarks and private-company compensation studies corroborate these ranges.

What You Need to Remember About Best Practices of a Chief Revenue Officer

The chief revenue officer is the architect of a company’s financial success and embodies a unique blend of strategic vision and operational excellence. Embracing these best practices enhances a CRO’s efficacy and ensures that the company thrives in a competitive marketplace, with its sights set on a prosperous future.