Back in 2015, Ry Walker founded Astronomer, a data workflow platform that helps organizations automate data pipelines and get more value out of their data. Prior to launching Astronomer, Ry led teams at a number of different companies, including a HR software provider, a job platform for veterans, and a high-growth startup studio.

In this UpLead Growth Chat, we sat down with Ry to pick his brain on how he evaluates startups and why he relies on a content strategy (instead of running ads). He also shares the key metrics that he tracks at Astronomer, and how he’s managed to 3x Astronomer’s revenue year over year.

To jump to specific segments of our interview, click on the relevant links.

Early career and personal growth

Will: One of the earliest projects you worked on was Sharkbytes, which is one of the first web interactive agencies in the United States. How did you come up with the idea of starting Sharkbytes?

Ry: When we saw that companies were building website in 1995, we thought, every company of substance should have a website. So we started going office-to-office to show people the web on our laptops, and we’d often unplug their fax machines to connect.

Our most common early reaction was “Can you please plug the fax machine back in?” Despite all that, we built over 400 websites in 4 years.

Will: You grew Sharkbytes to to $5MM+ in revenue before selling it off in 1999. Did you encounter any problems with hiring and scaling your agency?

Ry: Absolutely. Even if a company is moderately profitable from a P&L standpoint, growth of Accounts Receivable demands working capital. For us, it was tough pulling together $200k from customers every half month for payroll.

“Cash was always tight, and it was the primary limiter to our growth.”

Will: On another note, did you go into Sharkbytes having already formulated an exit strategy? Or did everything just fall into place after a few years?

Ry: Nope, we didn’t have an exit strategy. We were just having fun, doing something we enjoyed. Our team was made up folks who were initially building websites as a hobby, so when we hired them, they were essentially getting paid to do what they love.

It was only when USWeb started rolling up web agencies that we realized there could be an interesting exit for us.

Will: In 2003, you joined The Devine Group as their Vice President of Technology. What did you learn here, and why did you eventually leave the company?

Ry: Devine was a customer of our since 1997, we helped move their assessments from “fax in your answer sheet” to a fully online business. We eventually automated the OCR process for reading faxed answer sheets. During my time there, Ruby on Rails emerged, and I fell in love with open source. I left to get back to running my own company, but right as I was leaving, RecruitMilitary got in touch.

Will: That’s right, you went on to join RecruitMilitary as their CEO — that’s Chief Experience Officer. Tell us more about your stint here.

Ry: Drew Myers, the real CEO of RecruitMilitary, reached out to me, saying that he really needed help for his fast-growing business.

I decided to put my entrepreneurial urges on hold a bit longer, and help him out of a jam. He gave me a lot of freedom, and we hired a small team and rebuilt all the tech from the ground up. I left to get back to running my own company again, finally 🙂

Will: This brings us to 2013, when you co-founded Differential, a software innovation agency that “defines, de-risks and delivers custom software solutions that solve growth problems” for startups and other businesses.

Here’s what’s interesting — the agency gets paid in either equity, or a combination of equity and cash, for the work that it does. How did you guys evaluate these startups, and decide which had enough potential for you to accept your earnings solely in equity?

Ry: We evaluated these projects exactly like any angel investor would – is the product interesting? Do we have faith in the founders? Is it a big market? Do they show signs of traction? We ended up taking equity in just a few companies, and focused more on building out MVPs for our own ideas.

Will: On the flip side, what’s a red flag that indicates that a startup isn’t on the right track?

Ry: It’s a bad sign if the founder isn’t in touch enough with reality, and refuses to see how off their viewpoint is. It’s important to really understand the current state of the world, and how you’re going to move people to your view. It’s like yin-yang (being grounded in reality/living in your own reality distortion field); you have to achieve BOTH at the same time to be a great founder, and to be credible.

Will: Can you give us any specific anecdotes/examples of how a founder might not be in touch with reality?

Ry: I’ve been that founder 🙂 The way I see it,

“It’s a delicate balance between believing your vision and observing reality, and it’s easy to get off balance in favor of drinking your own Kool-aid.”

I find myself doing this a lot when the CORE of the product I’m building works and is valuable, but the EXTERIOR surface isn’t clear (marketing copy, website structure, onboarding flow, etc.) It’s important for me to continuously do tests with people from outside the company to be sure I’m not failing a crucial communication.

Building and growing Astronomer.io

Will: You eventually left Differential to work on Astronomer.io, which is what you’re focusing on now. What happened here?

Ry: The goal was to build a venture-backed technology startup, as a step to eventually becoming a venture capitalist.

Astronomer came out of a project we were working on called USERcycle. Differential funded that work, so I ended up trading my equity in Differential for maximal equity in this new project. On paper, it wasn’t probably a great deal, but I wanted to be all in. Like Captain Hernán Cortés, I wanted to “burn my ships at the shore.”

Will: Astronomer is a data workflow platform built around Apache Airflow. How would you explain it to entrepreneurs — or even laypeople — who aren’t techies?

Ry: Simply put, we help organizations get a more continuous stream of value from their investments in big data and data science.

To unpack this a bit, many data teams are underperforming in delivering value to the company that they work for. The problem is that data projects are typically being executed in a waterfall method. We learned in software development that waterfall is bad, and that agile (which involves a continuous delivery of value) is the way to go.

With Astronomer, we’re simply bringing that agile software development methodology to a domain that is really crusty. The era of a “data integration team” handling all the company’s “ETL” is ending. Instead, Airflow allows you to embed software engineers into data teams, and continuously ship better data pipelines to power analytics and digital products.

Will: What channels do you rely on to promote Astronomer? What percentage of your marketing budget do you put in each channel? Which channel has had the greatest ROI for you so far?

Ry: We’re entirely reliant on content marketing. We’ve got no budget for ads right now, and anyway,

“We want prospective customers to come to us based on their needs, versus us having to “sell” our product.”

If we pay for ads, our net gets filled with a wider variety of species of fish, and it takes a more sophisticated team to deal with that variety. So based on where we are now, we’ve created a steady stream of good-fit customers to process through our sales funnel, and we’re happy with that.

Astronomer.io’s content marketing and user retention strategies

Will: Could you walk us through your content marketing strategy?

Ry: It’s pretty simple. We write guides and blog posts, record podcasts, and create product updates that we share on relevant social channels such as Reddit, Hacker News, Twitter, LinkedIn, and our email list.

Will: You’ve got an Astronomer SpaceCamp program, which is an Apache Airflow training and education program for teams looking to run Airflow at scale. How much did you invest into building this program?

Ry: We’ve invested very little to build the program; it actually evolved based on customer engagements, with the development being paid for by customers. These type of training programs are fairly common for companies like ours, so it seemed like a no brainer to get it started.

Will: You also produce an Airflow Podcast that talks about Apache Airflow. Why did you decide to launch a podcast instead of, say, spending more time and energy on your blog?

Ry: I’m personally a big fan of podcasts, and we had success at Differential running a podcast on Meteor (a javascript platform that we used a lot). So it’s just another facet in our content strategy. I think podcasts are great though, and are continuing a slow rise towards prominence.

Will: How does Astronomer reduce churn and increase retention? Please share specific strategies, numbers and tools if possible.

Ry: We have always had someone on the team with a “success” title, and we’ve recently broken the team up into smaller pods, two of which are really focused on increasing our “net new ARR” – this means bringing in new customers, expanding customers, and avoiding churn, revenue contraction.

Will: Considering the effort to reward ratio, is it more worthwhile for Astronomer to serve its Airflow, Cloud or Enterprise clients?

Ry: 75% of our revenue comes from 25% of our enterprise customers, so those customers are definitely more profitable to serve. That said, we believe that having a well-rounded offering improves the product experience for everyone. Our content attracts both types of prospects, so we want a solution for everyone.

Astronomer.io’s evolution and success

Will: What is the one thing that the team struggled with the most in Astronomer’s early days? What is the thing that you’re struggling the most with right now?

Ry: In the early days, we struggled a lot with product-market fit. But as we’ve come to find, this isn’t a destination; it’s a spectrum.

“These days, we’re struggling with getting to a repeatable, scalable, profitable growth process.”

We’re making progress, but it’s not easy. We’re essentially trying to remove boulders from a stream that’s constantly changing. Some things (like improving our security documentation) can be very time consuming, and we’re working to get into the marketplaces for AWS, Pivotal, Google, etc. At the same time, our customers need us to implement features in our product so they can use it, and there’s added time pressure to get that done.

Will: What three factors would you attribute Astronomer’s success to?

Ry: Grit, flexibility, and openness.

Will: What are the three most important metrics that Astronomer monitors?

Ry: Those would be…

- Net new ARR growth rate. We want our net new ARR (new + expansion – lost – contraction) to increase steadily. David Skok from Matrix Partners talks a lot about this.

- Current ARR – it’s the first question investors ask.

- Runway – we don’t want to die 🙂

Plus, here are some key metrics that we also keep track of:

- Total Customers

- Lighthouse Customers

- Current ARR

- AACV – average annual contract value.

- Workflows – how many Airflow workflows does the customer currently run on our platform? The more they’re using the product, the more likely they are to stay, and the more likely that our revenue with them will increase.

- Total Revenue – includes subscription revenue and services revenue.

- POCs – number of proof-of-concept or trial projects we are currently engaged in. We want at least 50% of our POCs to convert to paid recurring customers.

- Pipeline – total value of all deals in our sales pipeline.

- WtPipeline – value of deals x probability.

- Deals – total # of deals in our sales pipeline.

- Average Deal Size

- Quarterly Bookings

- Win Rate

- Avg Sales Cycle (Days)

- Sales Velocity = #_Qualified_Opportunities x %_Win_Rate x $Deal_Size / Sales_Cycle_in_Days

- Days to 1.0 – we’re pushing to get a major product release out, we track velocity of our development team vs. the backlog of work to project when we’ll hit the release date.

- ARR Growth Rate (T5M)

- ARR per employee

- Cash on Hand

- Monthly Burn (T5M)

- Rev vs. Burn (T5M)

- Runway (Months)

Will: How has Astronomer evolved from when it was first launched? How do you decide what new features you want to work on?

Ry: We started as a clickstream library for Meteor apps. Then we evolved into a general clickstream platform. Then we added an Airflow module. Then we spun off clickstream to be only Airflow. Then we rebuilt everything on top of Kubernetes (started that in April 2018). Then we launched the cloud service in July. It’s been a lot of change!

We use Pivotal Tracker to collect and sort through everything that we could work on.

Will: What is Astronomer doing in yearly revenue now? What are your revenue goals or other goals moving forward?

Ry: We won’t disclose this, but we 3x’ed our revenue in 2018, and expect to 3x it again in 2019.

Lifehacks, sources of inspiration, and tips on relaxation

Will: What is your favorite lifehack? (Business or non-business related).

Ry: I like to listen to podcasts while doing boring work (dishes, trimming hedges, pulling weeds, cutting lawn, folding laundry). This instantly makes that work something that you look forward to (or dread less, at the very least).

Also, as you’re trying to build a name for yourself, write a blog post weekly. I find this tremendously helpful; it forces you to think clearly and be interesting.

Will: Which entrepreneur, leader or business owner inspires you the most?

Warren Buffett, by a big margin. He works on the other end of the innovation cycle that I do, so it’s interesting to see how he tackles this. While I deal primarily with startups (which I see as seedlings driven by innovation and agility), Warren Buffet is a master at harvesting value from mature companies that are consistently producing fruit.

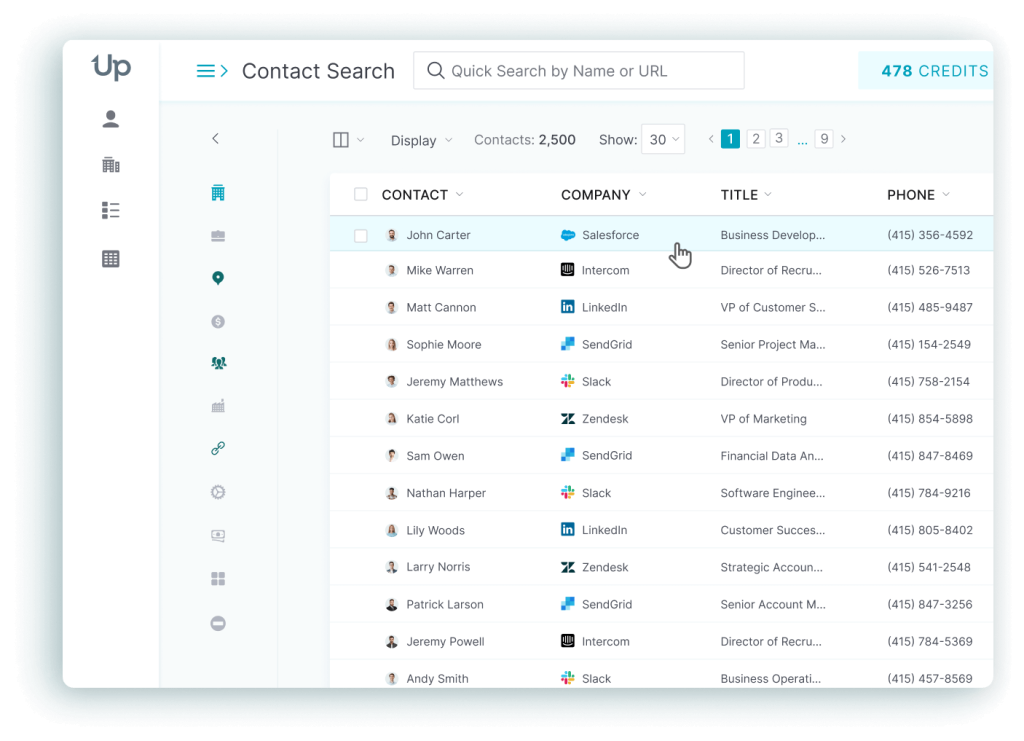

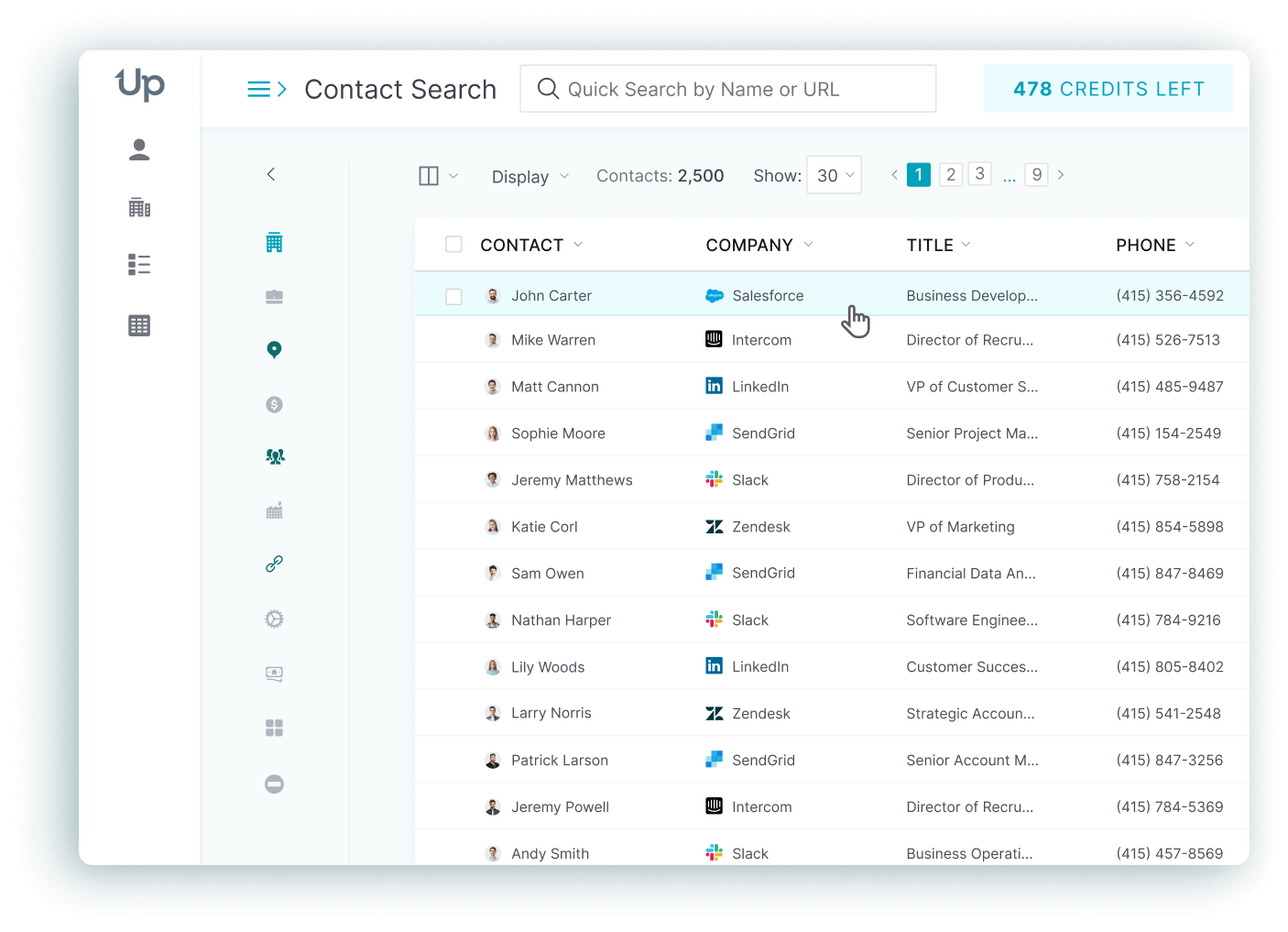

Will: What business tool would you find it hard to live without?

Ry: My laptop! Also, Slack, Things, Basecamp, Google Docs, Gmail, LinkedIn, Recruitee.

Will: If you had $100,000 to invest in one public company, what company would it be?

Ry: Amazon. They’ve won several markets (e-commerce and cloud infrastructure) that are going to continue to grow. What’s next, space?

Will: What do you do to destress and relax?

Ry: I play complex strategy games (I’ve been playing one game, Dungeon Crawl Stone Soup, on my computer for years) and watch Netflix, Hulu, HBO Now, and stupid videos on Youtube with my wife and kids.