Your insurance agency’s growth is unpredictable. You’re caught in a cycle of chasing expensive and low-quality leads while your sales pipeline resembles a roller coaster of feast or famine. Outdated methods don’t work and the digital world is a noisy and hyper-competitive maze. With changing regulations and the rise of AI, the old playbook is broken. Your competitors are either adapting or disappearing.

This guide provides a complete and modern blueprint. We detail over 20 proven strategies organized into a four-pillar ecosystem. You’ll learn everything from mastering local search and using AI to building a referral machine and navigating critical compliance laws. This equips you to build a predictable and scalable lead generation engine for 2026 and beyond.

What Is Insurance Lead Generation?

Insurance lead generation is the process of attracting and identifying potential customers who show interest in your insurance products or services. A lead is anyone who provides contact information like a name, email or phone number. This signals they might need coverage.

Not all leads are equal. Understanding the temperature of your leads helps you prioritize your efforts:

- Hot leads: These prospects are ready to buy now. They’ve requested a quote, filled out a detailed form or asked to speak with an agent. Hot leads require immediate follow-up.

- Warm leads: These individuals have shown interest. Perhaps they downloaded a guide, attended a webinar or engaged with your content. But they’re not ready to purchase yet. Warm leads need nurturing through consistent and valuable touchpoints.

- Cold leads: These are contacts who fit your ideal customer profile but haven’t expressed any direct interest in your services. Cold outreach through email or calls can convert these prospects. But it requires more effort and persistence.

The goal of any lead generation strategy is to move prospects through this spectrum from cold to warm to hot and into paying clients.

Why a Strong Lead Generation Strategy Is Non-Negotiable

A strong lead generation strategy is non-negotiable because it determines your agency’s revenue stability and growth trajectory. Without a consistent pipeline of qualified prospects, your business is vulnerable to unpredictable income swings and increased dependence on referrals or expensive purchased leads.

Generating insurance leads helps insurance agents reach potential customers fast and efficiently. Instead of targeting people who may not be interested or even need what they offer, insurance professionals can focus on those looking for their services. This precision saves time. It reduces marketing waste. And it increases conversion rates.

Lead generation for insurance also helps insurance agencies build relationships with existing customers and prospects. They do this by providing relevant content such as educational materials and personalized offers. This keeps customers engaged and encourages them to buy more policies. Insurance businesses can use lead generation strategies to increase brand awareness. They provide valuable information about their product or service through various channels such as email campaigns and social media posts.

There are many ways that insurance companies can use insurance lead generation strategies to grow their insurance agency. For example:

- Allstate uses social media campaigns to target potential customers who are looking for advice on how to choose an insurer. They also use email campaigns to promote discounts on car insurance policies and other special offers like free home inspections if they buy a policy from Allstate.

- Geico has implemented a comprehensive digital marketing campaign that includes SEO-optimized website content and targeted Google Ads. This allows them to reach potential customers searching for different types of coverage online.

- Progressive offers a unique “Name Your Price” tool. It enables prospective customers to enter their desired monthly auto insurance payment amount. The tool then displays the plans that best match their budget based on their profile information.

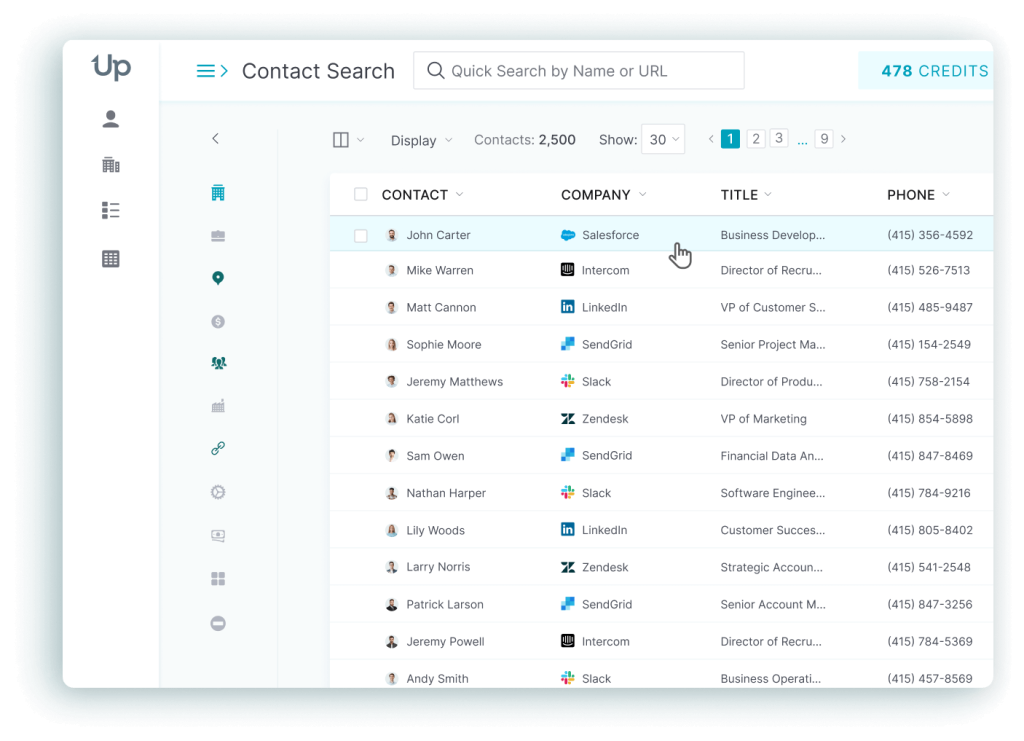

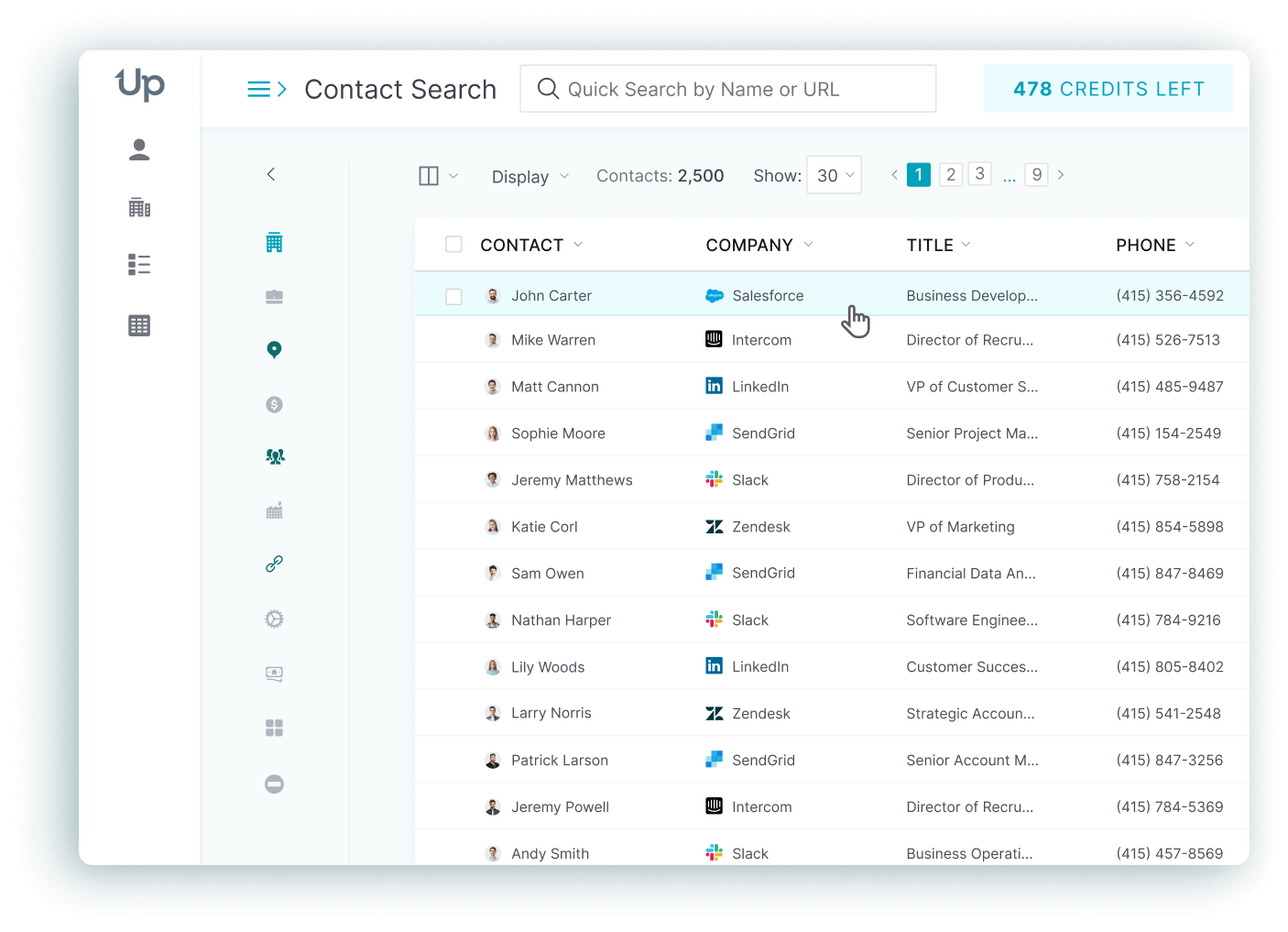

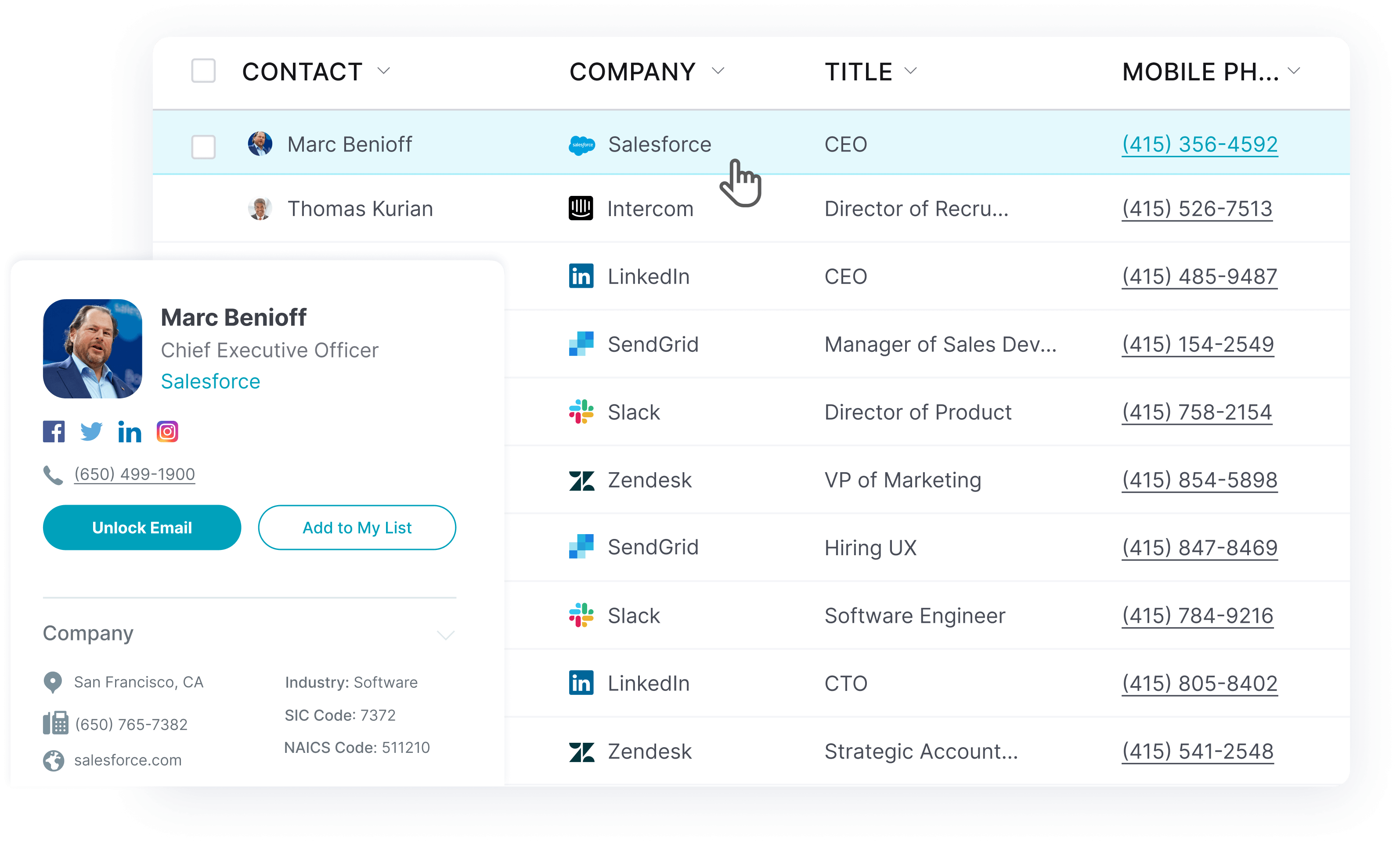

Lead generation doesn’t have to be all that painful. With UpLead, you can easily connect with high-quality prospects and leads to grow your company.

What Are the Key Challenges in Generating Insurance Leads?

The key challenges in generating insurance leads include intense market competition, low lead quality, building client trust and adapting to regulatory changes. Insurance agents face a crowded marketplace where standing out requires more than traditional sales tactics.

Intense Competition: The U.S. insurance market is saturated. There were 438,929 insurance broker and agency businesses reported in 2024. This is an increase of 1.5% from 2023. This crowded field includes major online players like GEICO and Progressive. It makes it difficult for individual agents to stand out and attract new clients. The overall U.S. insurance market was valued at $1.48 trillion in 2023.

Solution: Develop a niche specialization to target a specific market segment. Use digital marketing strategies like local SEO and content marketing to build online visibility. Create a unique value proposition that differentiates you from competitors.

Low Lead Quality and Quantity: A primary pain point is generating a steady stream of high quality leads. Many marketing leads (as high as 79%) never convert. About 50% of leads that are qualified are not yet ready to make a purchase. This is often because prospects don’t self-identify a need for insurance unless compelled by an event or requirement.

Solution: Implement a lead nurturing strategy. Use email marketing and automation to build relationships with prospects who aren’t ready to buy now. Use lead generation tools and a strong referral network to improve the quality of incoming leads.

Building Client Trust: Skepticism towards salespeople is a major hurdle. Building trust is critical but it’s a challenge when clients find insurance products complex and confusing. A lack of clear communication and education can lead to mistrust and dissatisfaction.

Solution: Focus on educating clients rather than just selling. Communicate proactively. Use simple language to explain policies. Set realistic expectations. And always follow through on promises. This establishes you as a trustworthy advisor.

Client Retention: High client turnover leads to revenue instability and increases the pressure to acquire new customers.

Solution: Provide exceptional and personalized customer service. Maintain regular communication with clients to understand their evolving needs. Offer loyalty programs and seek feedback to improve service.

A Modern Framework: 20+ Strategies for Generating Insurance Leads

Insurance lead generation tactics are adapting. As insurance agents seek leads interested in your products, staying on top of the latest trends and technologies is important.

Below are key strategies organized into four strategic pillars you can adopt to reach and convert more potential clients.

Pillar 1: Build Your Digital Foundation

Your digital foundation is the bedrock of all online lead generation efforts. Without a solid foundation, even the best marketing campaigns will underperform.

1. Build a High-Converting Insurance Website

Your website is your 24/7 salesperson. It must be fast and mobile-responsive. It must communicate your value proposition. Include clear calls-to-action (CTAs) on every page such as “Get a Free Quote” or “Schedule a Consultation.” Make sure your contact information is easy to find.

2. Master Local SEO

Local SEO is critical for agents as nearly half of Google searches are for local businesses. Key pillars include Google Business Profile (GBP) optimization, local citations, on-page SEO and review management.

Google Business Profile Optimization Checklist:

- Verification: Claim and verify your GBP listing.

- NAP Consistency: Ensure your Name, Address and Phone number are 100% consistent across all online listings.

- Categories: Select ‘Insurance agency’ as the primary category. Add specific secondary categories like ‘Auto insurance agency’ or ‘Life insurance agency.’

- Business Information: Complete every section. Use your exact business name, precise address, primary phone number and website URL.

- Description: Write a compelling and keyword-rich description of your agency, its services and unique selling points.

- Services: Use the ‘Services’ feature to list every insurance product you offer in detail.

- Photos: Upload high-quality and recent photos of your office (interior/exterior), team and logo to increase engagement.

- Google Posts: Use Google Posts to share updates, blog content or promotions. This boosts visibility and engagement.

- Q&A Section: Add and answer common questions. Monitor and answer user-submitted questions fast.

- Reviews: Encourage satisfied clients to leave reviews and respond to all of them, positive or negative.

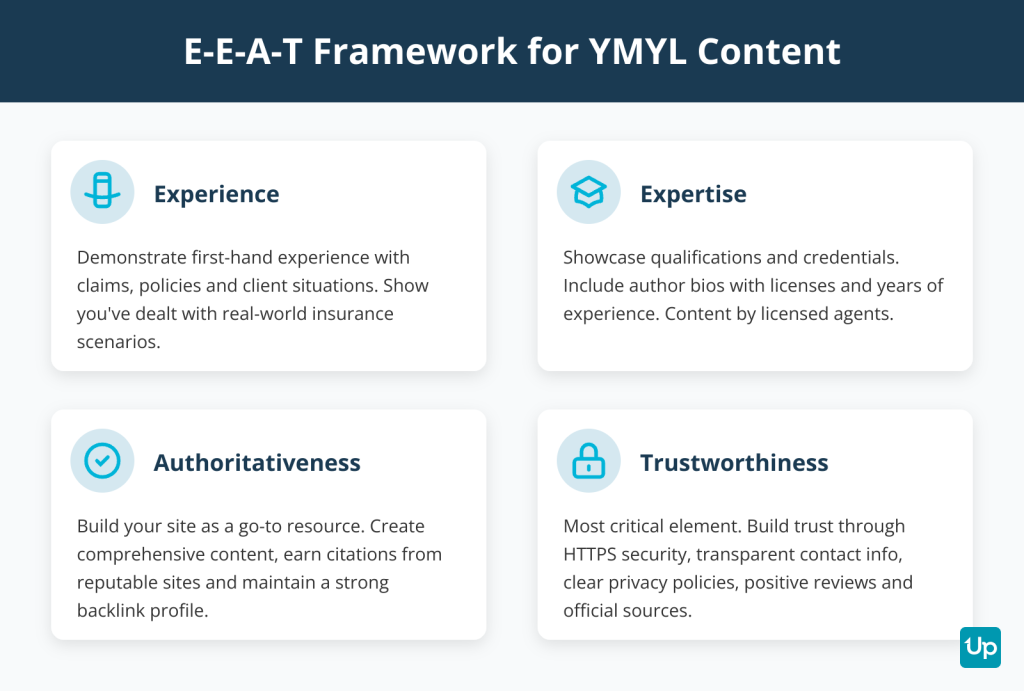

E-E-A-T for YMYL Topics: Insurance is a classic YMYL (Your Money or Your Life) topic because it can impact a person’s financial stability and safety. Google holds YMYL content to a much higher standard. This makes E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness) essential.

- Experience: Demonstrate first-hand experience. For an insurance agent, this means creating content that shows you’ve dealt with the claims, policies and client situations you’re writing about.

- Expertise: Showcase your qualifications. Content should be written or reviewed by a licensed agent. Include author bios with credentials, licenses and years of experience.

- Authoritativeness: Build your site as a go-to resource. This is achieved by creating comprehensive content, being cited by other reputable sites and having a strong and clean backlink profile.

- Trustworthiness: This is the most critical element. Trust is built through site security (HTTPS), transparent contact information, clear privacy policies, positive reviews and citing official sources.

Answer Engine Optimization (AEO): AEO is the practice of optimizing content to be featured in the answers provided by AI-powered tools like Google’s AI Overviews, Bing Copilot and ChatGPT. The goal is to be the cited source in a generated answer.

- Answer-First Content: Structure pages to provide a clear and concise 2-3 sentence summary answer at the very top before elaborating with details.

- Use Structured Data: Implement schema markup like LocalBusiness, FAQPage and Organization to help machines understand your content’s context.

- Entity-Based Language: Include key terms like your city, specific carrier names and product types.

- Cite Sources & Build E-E-A-T: AEO relies on E-E-A-T signals. Citing authoritative sources and demonstrating your own expertise and trustworthiness makes your content more likely to be used by AI engines.

3. Create High-Value Content That Answers Questions

We all know how powerful search engine optimization is for any online business. The same holds for sales and marketing teams looking to increase their leads for insurance agents. Adding relevant keywords, phrases and content optimized for search engines can boost your website’s visibility. This leads to more traffic and qualified leads. Creating SEO-friendly web content is essential to rank higher in search engine results. This means using relevant keywords throughout your web content to provide valuable information that answers customers’ questions and meets their needs. Using SEO best practices will help you stand out from the competition and attract more potential customers.

4. Optimize High-Converting Landing Pages

Landing pages often get overlooked for insurance lead generation. But they are one of the most powerful tools at your disposal. They can be used to capture and manage leads through web forms or chatbots. They provide potential customers with helpful information about your product or service before they make a purchasing decision.

When creating landing pages, keep them focused on one theme or topic related to your business. This way visitors know what they’re getting when they click through a link or advertisement they saw online. Make sure that all forms on these landing pages are short so visitors won’t get overwhelmed by too many questions or requests for information at once.

Pillar 2: Drive Traffic and Engagement

Once your foundation is solid, you need to drive targeted traffic to your website and engage prospects where they spend their time online.

5. Run Targeted Paid Advertising Campaigns

Paid media such as Google Ads or Facebook Ads offer an additional avenue for generating leads in the insurance industry. Paid campaigns enable insurance companies to target their audience more by focusing on specific demographics, locations, interests and more. This makes it easier for insurers to connect with potential customers online. These campaigns provide detailed analytics that enable insurers to track the performance of their campaigns and optimize them over time. This ensures they are reaching the right people at the right time with the right message.

However, insurance keywords are expensive. Broad industry CPCs are around $3.77. But high-intent terms like ‘car insurance’ and ‘buy life insurance online’ can cost anywhere from $40 to over $100 per click. The average conversion rate for search ads in the finance and insurance industry also varies. Recent 2025 benchmarks range from a low of 2.55% to a high of 5.10%. This highlights the sector’s competitiveness. This means you need an optimized funnel to be profitable.

6. Leverage Social Media Marketing

Social media has become a potent tool for insurance lead generation in recent years. Social media platforms like LinkedIn provide many opportunities for businesses to connect with potential customers. With its ability to reach targeted audiences fast and efficiently, social media is a great way for insurance marketers to reach out to their target customers. Insurance marketers can identify key influencers within their industry and build relationships with them on social media. They can use analytics tools such as Sprout Social or Hootsuite. These relationships will help them build trust and credibility with their target customer base. This is essential when marketing products like insurance policies.

7. Use Video Marketing to Build Trust

Video marketing ideas for insurance agents include:

- Educational ‘Explainer’ Videos: Create short-form videos (under 60-90 seconds) for platforms like TikTok and Instagram Reels that answer common insurance questions or debunk common myths. This positions you as a knowledgeable and trustworthy expert.

- Client Testimonial Videos: Showcase satisfied clients sharing their positive experiences. These videos act as powerful social proof and build credibility. Authenticity is more important than high production value. Focus on real stories about how you helped a client. Always obtain written permission before sharing.

- ‘Meet the Agent’ or ‘Behind-the-Scenes’ Videos: Humanize your agency by introducing your team, showing a ‘day in the life’ or sharing your personal story about why you became an agent. This helps build a personal connection and makes the agency seem more approachable.

- Live Q&A Sessions: Host live video sessions on Facebook or Instagram to answer audience questions in real-time. This fosters direct engagement and reinforces your status as an accessible expert. Promote the session ahead of time to maximize attendance.

- Claim Success Stories: With client permission, share a brief story about how you helped a client navigate a difficult claim. This provides a concrete demonstration of your value and the importance of proper coverage.

8. Get Listed in Key Online Directories

Ensure your agency is listed in relevant online directories and insurance marketplaces. Consistent NAP (Name, Address, Phone) information across all platforms strengthens your local SEO and makes it easier for prospects to find you.

Pillar 3: Master Proactive Outreach

Waiting for leads to come to you is not enough. Proactive outreach puts you in control of your pipeline.

9. Launch Strategic Email Marketing and Nurturing Campaigns

Email marketing is a critical component of an effective lead generation strategy. By sending out targeted emails to potential customers, you can provide them with relevant information about your services and products. To ensure success with email marketing, it is essential to segment your audience according to interests, demographics and other factors in order to create personalized messages that speak to each recipient. A/B testing helps you determine which emails are most successful with potential leads so you can optimize future campaigns. Bonus: UpLead has Insurance Agents Email Lists ready for you!

These tactics are tried and true and have proven results. You can use strategic email campaigns as an effective way to reach out to potential insurance customers who are interested in what you have to offer. Be sure to craft targeted, personalized and timely emails so they resonate with your audience. Whether car or commercial insurance, providing relevant industry expertise to your valuable leads can enhance your marketing efforts.

10. Implement Strategic Cold Outreach

Cold outreach is another effective tactic that can be used by insurance businesses looking to scale lead generation for insurance. By using email databases such as UpLead, insurance agents can source a list of contacts that fit their criteria and send out cold emails or make cold calls introducing themselves and their services. When done right, outbound lead generation can communicate your message to potential customers without exposure to your brand or offerings. Cold outreach is one of the most effective ways to convert cold and warm leads into high quality insurance leads and advance them through the sales pipeline.

11. Develop a Formal Referral Program

Referrals are often the highest-quality leads because they come with built-in trust. Create a formal referral program that incentivizes your existing clients to recommend your services. Offer rewards such as gift cards or discounts on future premiums for every successful referral.

12. Build Strategic Partnerships

Partner with complementary businesses that serve your target market. For example, real estate agents, mortgage brokers and CPAs often encounter clients who need insurance. Establish mutual referral agreements that benefit both parties.

13. Cross-Sell and Upsell to Your Existing Client Base

Your current clients are a goldmine for new business. Review their policies to identify coverage gaps or life changes that create new insurance needs. A client who bought auto insurance may now need home insurance or life insurance.

Pillar 4: Establish Authority Through Networking

Building authority and trust in your community positions you as the go-to insurance expert.

14. Excel at Offline and Community Networking

Attend local chamber of commerce meetings, business networking events and community events. Face-to-face interactions build trust and familiarity in ways that digital marketing alone cannot.

15. Host Educational Webinars and Local Seminars

Position yourself as an expert by hosting free educational sessions on topics like “Understanding Medicare Options” or “How to Protect Your Small Business with the Right Coverage.” These events attract prospects who are seeking information and are more likely to convert.

16. Be a Guest on Relevant Podcasts

Seek opportunities to be interviewed on local business podcasts or industry-specific shows. This expands your reach and establishes you as a thought leader.

How Can AI and Automation Revolutionize Your Lead Generation?

AI and automation can revolutionize your lead generation by enhancing efficiency, personalization and conversion rates. Key applications include:

Predictive Lead Scoring: AI algorithms analyze vast datasets. This includes demographic information, online behavior and engagement history. They score leads based on their likelihood to convert. Instead of treating all leads the same, agents can use these scores to prioritize their efforts on high-potential prospects. This improves sales efficiency. For example, a lead who visits a life insurance page and uses a premium calculator would receive a higher score than a casual blog reader.

AI-Powered Chatbots: Chatbots integrated into an agency’s website or social media can engage prospects 24/7. They can answer common questions. They can provide insurance quotes. They can collect contact information. And they can even schedule appointments on an agent’s calendar. This ensures that no lead is missed, even outside of business hours. It frees up human agents from repetitive initial qualification tasks to focus on more complex client needs.

Automated and Personalized Lead Nurturing: For the many leads who are not ready to buy, automated workflows are critical. AI can trigger personalized email or SMS sequences based on a lead’s specific actions such as downloading a guide or clicking a link. These automated touchpoints deliver relevant content over time. They keep the agent’s brand top-of-mind and nurture the relationship until the prospect is ready to engage.

AI-Driven Data Analysis for Cross-Selling: AI tools can analyze an agent’s existing book of business to identify cross-selling and upselling opportunities. By detecting life events or coverage gaps in a client’s portfolio, the AI can prompt the agent with specific and relevant product recommendations. For instance, the system might flag a client with auto insurance who just bought a home as a prime candidate for a homeowner’s policy bundle. This data-driven approach makes cross-selling efforts more targeted and effective.

The Best Tools for Generating Insurance Leads

Generating insurance leads must be a priority for any company wanting to thrive in the modern market. Generating leads is an integral part of success for any business, for those businesses whose services depend on spreading their message and attracting customers. Some useful lead generation tools are available to help generate leads efficiently.

Lead Capture and Form Builders

OptinMonster: OptinMonster is a specialized lead conversion tool that uses various campaign types like popups, floating bars, slide-ins and fullscreen overlays with Exit-Intent technology to show offers to abandoning visitors. It features a drag-and-drop builder with 700+ templates, page-level targeting, A/B testing and integrations with major email marketing services. Pricing ranges from Basic ($9/month) to Growth ($49/month). The popular Pro plan ($29/month) includes Exit-Intent technology for up to 3 sites.

WPForms: WPForms is a used WordPress plugin installed on over 6 million websites. It offers over 2,000 pre-built templates including ‘request a quote’ forms, smart conditional logic, file uploads, multi-page forms, digital signatures and payment gateway integrations. Pricing ranges from Basic ($39.60/year) to Elite ($239.60/year). The Pro plan ($159.60/year) includes payment integrations and advanced features like surveys and digital signatures.

CRM and Lead Management

AgencyBloc: AgencyBloc is an industry-specific Agency Management System with built-in CRM designed for life, health and senior market insurance agencies. It’s a HIPAA-compliant platform with SOC 2 Type II audits. It offers client and policy management, commission processing and tracking, sales workflow automation and reporting. The platform is offered as a suite including AMS+, Commissions+, Engage+ and Quote+. Pricing is customized and available upon request.

Salesforce: Salesforce offers two distinct tiers. There is a general and affordable small business CRM ($25/user/month) suitable for basic lead management. And there is a powerful but expensive Financial Services Cloud ($325+/user/month) for agencies needing comprehensive and built-in insurance functionalities.

HubSpot CRM: HubSpot CRM offers a robust ‘forever-free’ CRM with unlimited users. This includes contact, company and deal management, one sales pipeline, email tracking and templates, meeting scheduler and reporting dashboards. The Sales Hub Starter plan costs around $15-$20 per user/month. It removes HubSpot branding while adding multiple deal pipelines and more automation features.

Email Marketing and Automation

ConvertKit: ConvertKit (recently rebranded to ‘Kit’) is an email marketing platform designed for online creators. Its core features include a visual automation builder, customizable landing pages and forms, subscriber tagging and segmentation and tools for selling digital products and subscriptions. Pricing is subscriber-based with a free plan for up to 1,000 subscribers. The ‘Creator’ plan starts at ~$29/month for 1,000 subscribers. The ‘Creator Pro’ plan starts at ~$59/month.

ActiveCampaign: ActiveCampaign is a robust customer experience automation platform that combines email marketing, marketing automation and a sales CRM. It offers over 900 ‘automation recipes’ for tasks like nurturing new leads, sending drip campaigns and tracking engagement. Pricing is tiered and based on contact count. The ‘Starter’ plan begins at around $19-$29/month for 1,000 contacts. The ‘Plus’ plan (from $49/month) adds a landing page builder, more advanced automation and a CRM.

Prospecting and Data

UpLead: UpLead is a B2B prospecting tool launched in 2017. It is positioned as a high-accuracy and cost-effective alternative to larger platforms. It offers a database of over 180 million contacts and claims a 95% data accuracy guarantee with real-time email verification performed before download. For commercial insurance agents, key features include over 50 search filters, technographics and buyer intent data. Pricing is credit-based with plans ranging from Essentials for $74/month (170 credits) to Plus for $149/month (400 credits). A custom-priced Professional plan is available. A 7-day free trial with 5 credits is available.

LinkedIn Sales Navigator: LinkedIn Sales Navigator is a premium B2B sales tool from LinkedIn designed for prospecting and social selling. Key features include advanced search filters (over 40 filters), lead recommendations, real-time alerts on lead and account activity and the ability to send InMail messages to connect with prospects outside one’s network. The official pricing for the Core plan is $119.99/month or $1,079.88/year. The Advanced plan is $159.99/month or $1,799.88/year. A free 30-day trial is available for new users.

SEO Tools

Ahrefs: Ahrefs is a comprehensive SEO software suite relevant for insurance agents. Its core features include ‘Keywords Explorer’ for discovering what potential clients are searching for, ‘Site Explorer’ for analyzing competitor backlink profiles and organic keywords and ‘Rank Tracker’ for monitoring keyword rankings at a local level. Pricing starts with a ‘Lite’ plan at $129 per month (or $108/month if billed annually) with higher tiers available.

Semrush: Semrush is an extensive all-in-one digital marketing platform relevant for insurance agents. Its key features include a ‘Keyword Magic Tool’ for comprehensive keyword research, competitor analysis tools and robust Local SEO tools. The Local SEO toolkit helps manage Google Business Profile listings, track local rankings with a ‘Map Rank Tracker’ and manage online reviews from a single dashboard. Standard SEO plans are ‘Pro’ at $139.95/month, ‘Guru’ at $249.95/month and ‘Business’ at $499.95/month with a 17% discount for annual billing.

Top Companies for Insurance Leads: When to Buy vs. Build

For insurance agents, the choice between buying leads and generating them is a strategic decision. It balances speed and cost against long-term asset building. A hybrid approach is often recommended.

Buying Insurance Leads (Done-For-You): This approach involves purchasing contact information of prospects from lead generation companies. It’s a popular strategy with over 60% of agencies using such services.

Pros:

- Speed and Immediacy: Provides instant access to a list of potential clients. This is ideal for new agents needing to build a pipeline fast or established agents filling a temporary gap.

- Predictable Lead Flow: Allows for scalable and predictable lead volume based on budget.

- Time Savings: Frees up the agent’s time to focus on selling and servicing clients rather than on marketing and prospecting.

- Targeting: Lead vendors often allow filtering by demographics, location and insurance type. This provides targeted prospects.

Cons:

- Cost: Can be expensive. Costs range from $1-$5 for aged leads to $25-$80+ for exclusive leads and real-time leads. This upfront cost has no guarantee of ROI.

- Lead Quality and Competition: Quality can be inconsistent with potential for incorrect contact information. If leads are ‘shared’ (sold to 3-8+ agents), competition is fierce and requires immediate follow up.

- Lower Conversion Rates: Shared and non-exclusive leads have lower conversion rates compared to generated ones.

- No Long-Term Asset: You are ‘renting’ access to clients. Once you stop paying, the lead flow stops and you haven’t built a sustainable marketing asset.

Generating Organic Leads (Do-It-Yourself): This approach involves creating your own lead flow through marketing efforts like SEO, content marketing, social media and networking.

Pros:

- Higher Quality and Exclusivity: Leads generated through your own efforts are exclusive and often have higher intent and trust. This leads to better conversion rates.

- Builds a Long-Term Asset: Your website, content and brand reputation become a sustainable lead generation machine that works for you 24/7.

- Cost-Effective Over Time: While it requires an upfront investment of time and effort, organic lead generation is more cost-effective in the long run compared to buying leads.

- Builds Brand and Trust: Organic marketing establishes you as an authority and builds deeper and trust-based relationships with prospects.

Cons:

- Time-Consuming: It takes time and consistent effort to build a strong online presence and see a steady stream of leads. Results are not immediate.

- Requires Expertise: Effective organic marketing requires knowledge of SEO, content creation and social media strategy.

- Slower Initial Results: It is a slow process to gain traction. This can be challenging for new agents who need immediate business.

Top Lead Generation Companies:

EverQuote: EverQuote is a major online insurance marketplace in the US. It was founded in 2011. It connects insurance agents with consumers seeking insurance quotes for auto, home and life insurance. The company claims to have over 10,000 agent partners. They generate leads through their own websites and a network of verified third-party partners. Lead types offered include data leads (real-time leads for Auto, Home and Life insurance), warm/live transfer calls (consumer-initiated inbound calls) and both shared and exclusive leads. Agent reviews are mixed with positive testimonials on their own site but negative reviews on third-party platforms citing poor lead quality and billing practices. The company has a ‘B’ rating from the BBB.

SmartFinancial: SmartFinancial is a digital insurance marketplace founded by industry veterans. The company is headquartered in Ohio and connects insurance shoppers with its network of over 6,500 agent and carrier partners across the United States. Lead types offered include live transfer calls (a flagship product where a consumer is pre-screened before being transferred to an agent) and web leads (both exclusive and shared). Leads are available for Auto, Home, Health, Life, Commercial and Renters insurance. SmartFinancial has a positive reputation with an A+ rating from the BBB.

QuoteWizard: QuoteWizard is a lead generation company founded in 2006. It was acquired by LendingTree in October 2018 and operates as its insurance division. The company provides insurance leads to over 7,000 agents monthly and has served more than 126,000 agents to date. It offers web leads and warm transfer calls for Auto, Home, Renters, Life and Health (including Medicare) insurance. A key feature is that shared leads are sold to a maximum of four agents. The company has a positive reputation among agents with an A+ BBB rating and being named ‘Best Value’ by the Leads Council.

How Do You Measure Your Lead Generation ROI?

You measure your lead generation ROI by tracking key metrics that connect marketing spend to revenue generated. The standard ROI formula is: ROI = [(Revenue from Leads – Cost of Lead Generation) / Cost of Lead Generation] x 100.

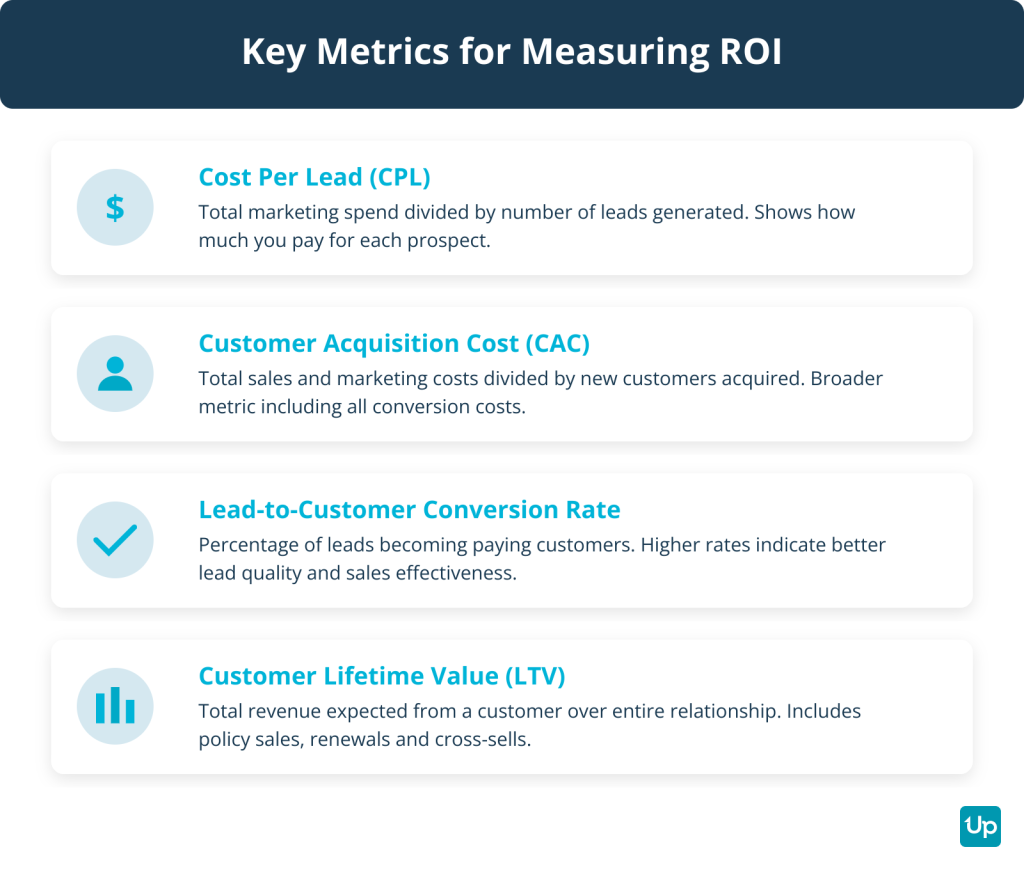

Key Metrics to Track:

- Cost Per Lead (CPL): Total marketing spend divided by the number of leads generated. This tells you how much you’re paying for each new prospect.

- Customer Acquisition Cost (CAC): Total sales and marketing costs divided by the number of new customers acquired. This is a broader metric that includes all costs to convert a lead into a paying customer.

- Lead-to-Customer Conversion Rate: The percentage of leads that become paying customers. A higher conversion rate indicates better lead quality and sales effectiveness.

- Customer Lifetime Value (LTV): The total revenue you expect to earn from a customer over the entire relationship. For insurance, this includes initial policy sales, renewals and cross-sells.

- LTV to CAC Ratio: Your LTV should be at least 3 times your CAC. This ensures that the revenue from a customer outweighs the cost to acquire them.

Review these metrics to identify which lead sources and campaigns deliver the best return. This allows you to allocate your budget more effectively.

How Do You Navigate Compliance in Insurance Lead Generation?

You navigate compliance in insurance lead generation by staying informed about regulations like the Telephone Consumer Protection Act (TCPA) and ensuring you obtain proper consent before contacting prospects.

Critical Update (January 2025): On January 24, 2025, the U.S. Court of Appeals for the Eleventh Circuit vacated the Federal Communications Commission’s (FCC) ‘one-to-one consent’ rule. This rule was finalized in December 2023. It was intended to close the ‘lead generator loophole’ by requiring businesses to obtain consent from a consumer for ‘no more than one identified seller’ at a time. It also required that the subject of the marketing calls be ‘logically and topically associated’ with the website where the consumer provided consent. The rule was scheduled to take effect on January 27, 2025. The Eleventh Circuit court found that the FCC exceeded its statutory authority. The court stated the new restrictions conflicted with the ordinary meaning of ‘prior express consent’ as defined in the TCPA. As a result, the one-to-one consent rule is not in effect.

Current Best Practices:

- Current best practices for insurance agents revert to the established TCPA standard. This requires obtaining ‘prior express written consent’ for telemarketing calls and texts using an automated system or prerecorded voice.

- This consent must be a clear, conspicuous and unambiguous written agreement (an electronic signature is valid) from the consumer that authorizes the seller to make contact.

- The burden of proving that clear consent was obtained remains on the business making the calls or sending the texts.

- Maintain records of consent as a best practice for legal protection. The legal landscape remains contentious and consumer trust is paramount.

A lead generator in insurance is used to help agents and brokers acquire meaningful information from prospects. It can be online or integrated into an agency’s website, allowing visitors to submit contact information and answer questions about the products they are interested in. Insurers can use this data to qualify leads, prioritize outreach strategies and allocate resources to get the most out of their insurance lead generation efforts.

Insurance leads are generated using effective marketing techniques. These include PPC campaigns, SEO optimization, social media, email campaigns and cold calling. Insurance leads are often derived from referrals since every satisfied customer will suggest a product or service they believe will benefit others.

Conclusion: Building Your Lead Generation Machine

Insurance lead generation can be a powerful tool for businesses looking to increase their client base. Being successful in the practice requires understanding the different methods used to acquire leads and the necessary technologies for tracking and optimizing lead performance. To ensure success, you should adopt best practices such as creating targeted landing pages, developing tailored campaigns to attract potential customers and segmenting audiences based on their needs and preferences.

As your insurance company evolves, you can optimize and scale the insurance lead generation process with the right tool. You can generate new leads and grow your insurance products more efficiently using these strategies for generating insurance leads.